As Wall Street, CNBC, and feckless politicians tout American energy independence from the miracle of shale oil, reality is already rearing its ugly head. Production grew by 24% over the first six months of 2012. Production has grown by only 7% over the first six months of 2013. That is a dramatic slowdown. The fact is that these wells deplete at an extremely rapid rate. Oil companies will always seek out the easiest to access oil first. They have already accessed the easy stuff. This explains the dramatic slowdown. Peak Bakken oil production will be below 1 million barrels per day. The last time I checked, we consumed 18 million barrels per day. I wonder when that energy independence will be achieved? Reality is a bitch

Bakken Oil Production Growth Has Slowed Significantly In 2013

By: Devon Shire

http://seekingalpha.com/author/devon-shire

The headlines ring of “booming” American oil production and “gluts” of oil (USO). I’m here to tell you that while the boom is real, there is no glut of oil and we need to be aware that the huge production growth of the past eighteen months is going to slow.

It already is slowing.

I’ve been watching what is going on in the Bakken pretty closely because I think it is going to be an excellent proxy for what will happen across the country.

Let’s take a look at what happened to production in North Dakota during the first six months of last year (2012). Here is the raw data detailing barrels of oil production per day:

December 2011 – 535,000 boe/day

January 2012 – 547,000 boe/day

February 2012 – 559,000 boe/day

March 2012 – 580,000 boe/day

April 2012 – 611,000 boe/day

May 2012 – 644,000 boe/day

June 2012 – 664,000 boe/day

Daily production in North Dakota increased by 129,000 barrels per day from December 2011 to June 2012.

Now let’s look at the same period for this year (2013):

December 2012 – 768,000 boe/day

January 2013 – 739,000 boe/day

February 2013 – 780,000 boe/day

March 2013 – 785,000 boe/day

April 2013 – 793,000 boe/day

May 2013 – 811,000 boe/day

June 2013 – 821,000 boe/day

Where last year production increased by 129,000 barrels per day in the first six months of the year, this year production is up by only 53,000 barrels per day.

Yes, the rate of growth in the Bakken has slowed considerably in 2013.

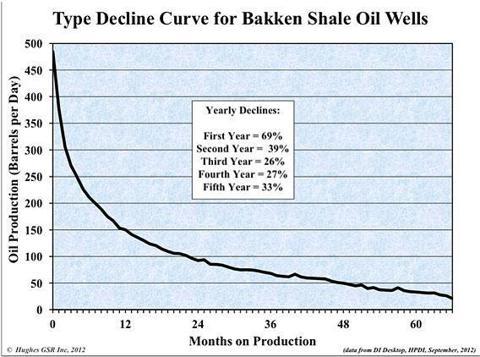

To understand why, a person needs to look at the production profile for these horizontal oil wells.

By the end of the first year of production, a new well is producing at a rate that is 30% of where it was the year before. That means a huge amount of drilling each year has to be done just to offset the production lost due to these steep decline rates.

Without a continuous step change each year in the number of wells being drilled and the capital available to do so, production in the Bakken is going to flatten.

Good things are still happening, but we can’t repeat every year the hyperbolic growth that we saw in 2012.

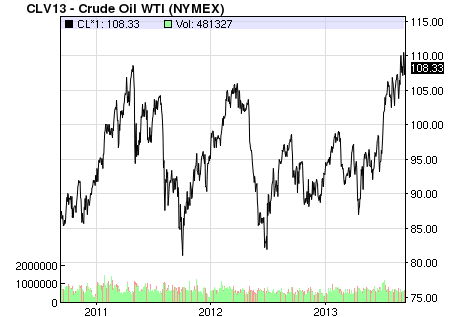

What this means for investors is that we shouldn’t expect oil prices to fall much from where we have seen them over the past three years.

For the past three years WTI oil prices have ranged from $85 per barrel to $105 per barrel. I think $85 is about as low as we can go for an extended period of time because that is likely just about the marginal cost of production for oil in the world today.

Production growth in the Bakken is slowing and so too will production growth in the Eagle Ford. That is the nature of these horizontal oil fields. We get an initial surge in production as capital comes into the play. Then that growth rate slows steadily until it flattens and enters a decline.

No comments:

Post a Comment